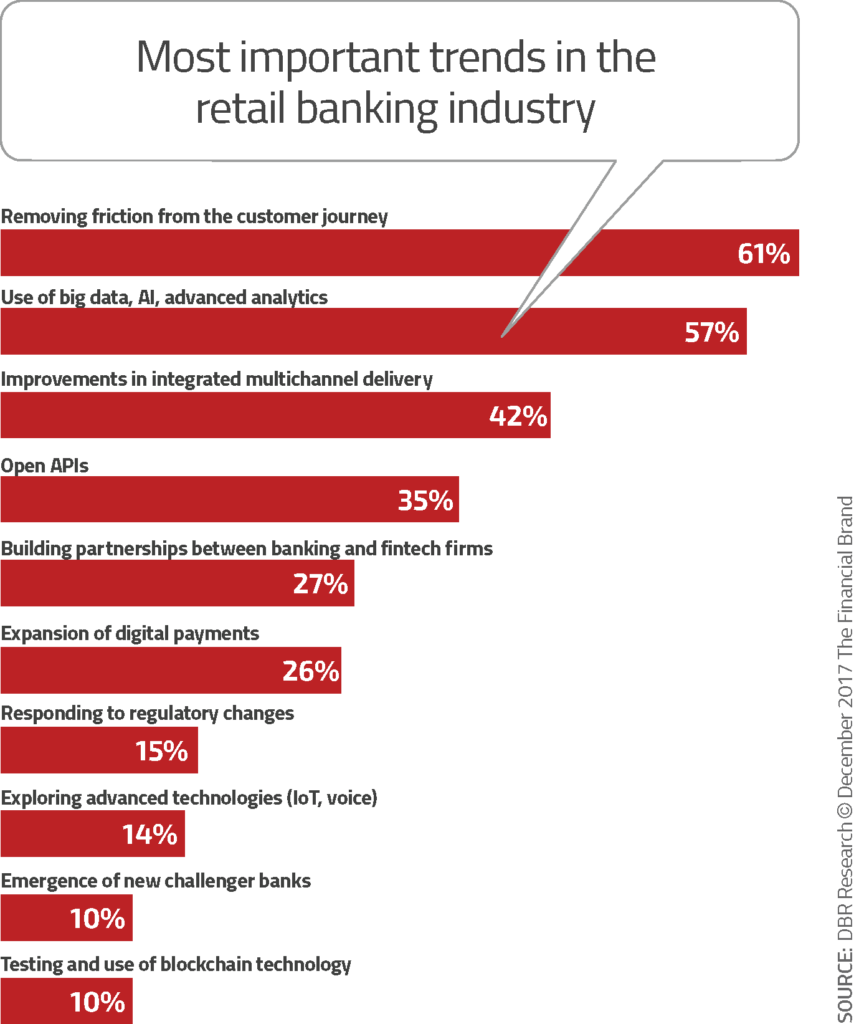

Banking industry trends in 2018 remain consistent with last year’s trends. According to Financial Brand’s 2018 Retail Banking Trends Report, Improving the Customer Journey and Improvement in Integrated Multi-Channel Delivery stayed in the top 3. While these trends are separate, each is entwined into the other.

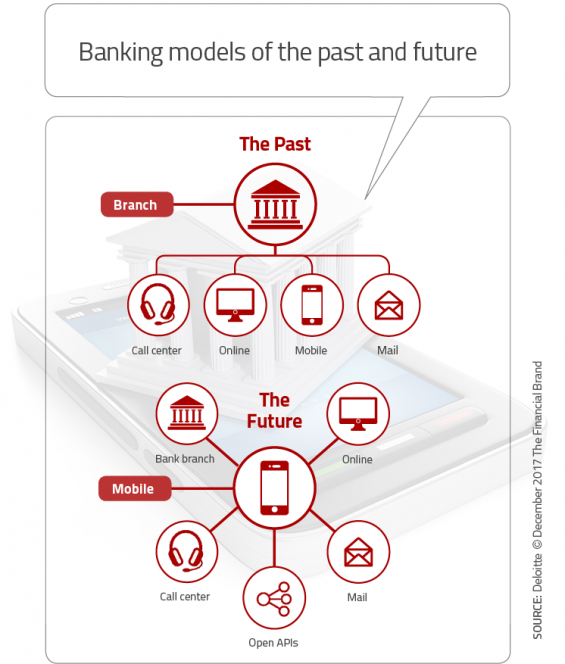

Customers want a seamless experience with their banks. They want the flexibility to choose the most efficient way to interact with their bank. To achieve this, banks must improve their digital offerings while maintaining a strong branch and contact center presence. Many customers are shifting the simple, day-to-day transactions online while using the branch or contact center for more complicated transactions. Yet there are still customers who prefer to walk into a branch to handle their banking needs. Banks need to create an experience that will satisfy the varied paths its customers may take to complete their financial transactions.A true omnichannel experience spans all points of interaction between the customer and the bank, providing not only consistency across channels, but the ability to pause and resume with no interruption to intended service. Consumers are experiencing this seamless integration with other industries like Netflix or Amazon. With these two companies, no matter which channel the consumer chooses to access the product or service, the customer’s experience is consistent.Here is a couple of examples of multichannel experience in banking. A customer starts a loan application online but runs into a question and stops the application. The same customer calls the bank’s contact center to get an answer to the loan application question. The customer service representative finds the online application, hears the question, and answers without the customer having to explain or reenter the information captured. That same customer uses the bank’s drive-through to do a simple transaction, the teller sees from pulling up their account they had started a loan application but didn’t complete it. The teller at this point asks the customer if they want help and assists or not based on the customer’s intentions and answer to a question.

Customers want a seamless experience with their banks. They want the flexibility to choose the most efficient way to interact with their bank. To achieve this, banks must improve their digital offerings while maintaining a strong branch and contact center presence. Many customers are shifting the simple, day-to-day transactions online while using the branch or contact center for more complicated transactions. Yet there are still customers who prefer to walk into a branch to handle their banking needs. Banks need to create an experience that will satisfy the varied paths its customers may take to complete their financial transactions.A true omnichannel experience spans all points of interaction between the customer and the bank, providing not only consistency across channels, but the ability to pause and resume with no interruption to intended service. Consumers are experiencing this seamless integration with other industries like Netflix or Amazon. With these two companies, no matter which channel the consumer chooses to access the product or service, the customer’s experience is consistent.Here is a couple of examples of multichannel experience in banking. A customer starts a loan application online but runs into a question and stops the application. The same customer calls the bank’s contact center to get an answer to the loan application question. The customer service representative finds the online application, hears the question, and answers without the customer having to explain or reenter the information captured. That same customer uses the bank’s drive-through to do a simple transaction, the teller sees from pulling up their account they had started a loan application but didn’t complete it. The teller at this point asks the customer if they want help and assists or not based on the customer’s intentions and answer to a question.

Banks need to adopt this omnichannel strategy to hold on to customers. The banks that don’t adopt omnichannel strategies risk losing customers. This same adaptability—coupled with high expectations for consistency and ease across multiple platforms—can make a customer more likely to switch banks to find a bank and products that satisfy their expectations.Here is an article that provides tips for banks to make the omnichannel transformation.

Banks need to adopt this omnichannel strategy to hold on to customers. The banks that don’t adopt omnichannel strategies risk losing customers. This same adaptability—coupled with high expectations for consistency and ease across multiple platforms—can make a customer more likely to switch banks to find a bank and products that satisfy their expectations.Here is an article that provides tips for banks to make the omnichannel transformation.

Click Here