Caution Emerging in Wake of Silicon Valley Bank Collapse

The MSR Group recently conducted a national research study on banking customers’ fears in the wake of Silicon Valley Bank’s collapse. Caution is emerging within the banking sector in the wake of the collapse of Silicon Valley Bank (SVB). On Tuesday, Moody’s flagged several regional financial institutions that share some of the same risk factors as the failed bank and either downgraded or is reviewing the ratings of seven of these banks, including First Republic Bank and Zions Bancorp. These risk factors include high amounts of unrealized losses held by some banks and large shares of deposits that aren’t covered by the Federal Deposit Insurance Corporation (FDIC).

Regional bank stocks have faced a difficult year, but the situation improved slightly on Tuesday when President Joe Biden reassured Americans of the safety of the U.S. banking system and regulators pledged that all deposits at SVB would be available to customers. In response to this, some businesses and individuals are switching from smaller banks to larger U.S. institutions such as JPMorgan Chase and Bank of America in the wake of SVB’s failure, the Financial Times reported.

Risk Factors for Other Banks

UBS Global Wealth Management’s chief investment officer Mark Haefele noted that there were unique elements to the SVB situation, such as having the highest ratio of securities to total assets of any U.S. bank and a far higher than average proportion of its depositors being corporate clients in the technology sector. Despite this, he said, “the fundamental challenge Silicon Valley Bank faces is also a risk for other banks.”

SVB had been a profitable bank prior to its closure by California regulators, but it failed after the Federal Reserve’s aggressive series of rate hikes hit the value of its bond portfolio. This required the bank to begin selling its holdings at a loss, and as the tech sector started to slow, the bank’s deposits began to decline. This, combined with its announcement of plans to sell assets and raise capital, caused a panic among depositors and led to SVB’s closure less than two days later.

Perception of Increased Safety in Larger Banks

The MSR Group found that many businesses and individuals are switching to larger U.S. banks in order to feel more secure. Furthermore, Moody’s is warning seven regional banks, including First Republic and Zions Bancorp, of potential risk factors that were present in SVB. The FDIC’s standard insurance covers up to $250,000 per depositor, but some people still worry that this may not be enough. While the Federal Reserve’s aggressive response has helped to calm nerves, depositors and investors should still examine banks’ balance sheets to make sure they are up to date.

The perception of increased safety in larger banks may be more psychological than anything else. Wells Fargo analyst Mike Mayo noted that JPMorgan Chase “epitomizes our theme of ‘Goliath is Winning,'” and that recent events should further its ability to gather core funding and act as a source of strength, due to its battle-tested experience. Patriarch Organization chairman Eric Schiffer added that when the Federal Reserve reassures the public that all is safe, the risk to smaller banks is reduced significantly.

Further Ramifications

In addition to these issues, the failure of SVB may have further ramifications for the banking sector, such as driving stricter capital requirements. Eurasia Group said that recent bank failures will likely lead lawmakers to change their approach to how they handle uninsured deposits, which would require legislation.

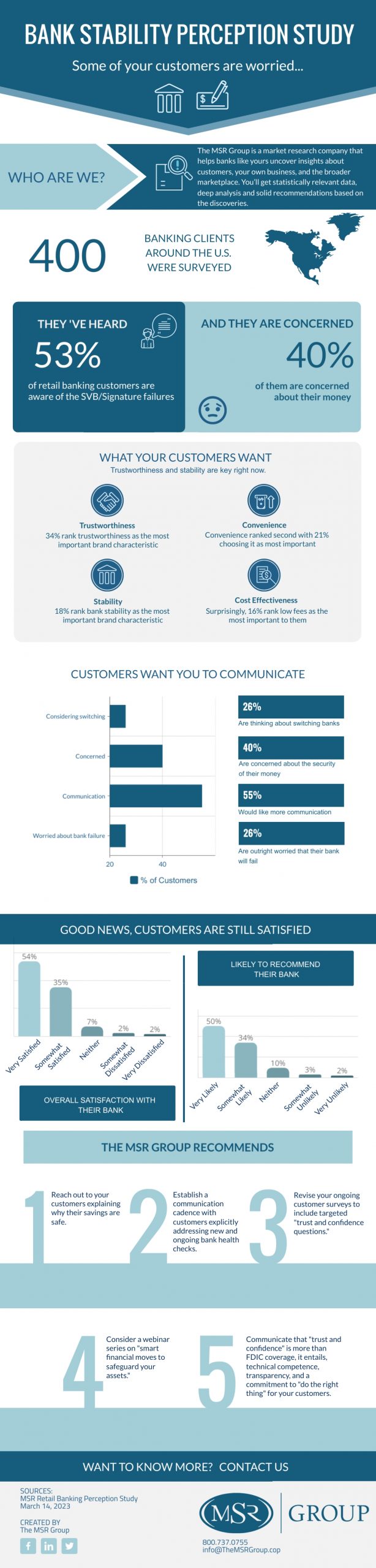

The MSR Group Research Study

The MSR Group’s research study on banking customers’ fears will be highlighted in an infographic to provide further insight into their reactions to the events surrounding Silicon Valley Bank’s collapse. This research, in conjunction with the responses of federal regulators and the warnings from Moody’s, should give individuals and businesses a better understanding of the risks involved in choosing a bank and the steps they can take to ensure the safety of their deposits.

Banks should contact The MSR Group for more research on banking customers’ fears in the wake of Silicon Valley Bank’s collapse.